Salary paycheck calculator massachusetts

Free Federal and State Paycheck Withholding Calculator. There are multiple ways to adjust your tax withholding.

Senior Associate Tax Salary In Boston Ma Comparably

Choose either the percent of your gross salary contribution or your per pay dollar contribution.

. The top ten percent of employees in the Department of Energy earn 18 of the total income. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. It can also be used to help fill steps 3 and 4 of a W-4 form.

Switch to hourly calculator. See the top 100 most well paid employees in Veterans Health Administration. Free Check Stub Maker with Calculator for Instant Paychecks.

Payroll check calculator is updated for payroll year 2022 and new W4. Instead you fill out Steps 2 3 and 4. From stock market news to jobs and real estate it can all be found here.

The most common payscale is General Schedule. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State. Salary Paycheck and Payroll Calculator.

Getting to use free check stub maker with calculator is no less than a boon. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free federal paycheck calculator. Do NOT include any employer match or your spousepartners employer-sponsored plan contributions.

Get breaking Finance news and the latest business articles from AOL. Once you get habituated with this check stubs generator youll surely ditch the old-fashioned ways of paycheck creation. See the top 100 most well paid employees in Department of Energy.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Department of Energy belongs to the Department of Energy. Nurse followed by medical support assistance.

Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories. This calculator is intended for use by US.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by. Income to be taxed as supplemental income. How You Can Affect Your Connecticut Paycheck.

The most common payscale is General Schedule. Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Gross Salary per Pay Period. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Florida.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. That means the lowest salary a man thinks is acceptable at a new job is about 37 higher than the lowest wage a woman does. We use the Consumer Price Index CPI and salary differentials of over 300 US cities to give you a comparison of costs and salary.

Calculating paychecks and need some help. General engineering followed by miscellaneous administration and program. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

Non-Tax Deductions Non-tax Deduction. The Veterans Health Administration belongs to the Department of Veterans Affairs. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

Before Tax Retirement. The maximum elective deferral amount is. Paycheck Calculator Calculate your take home pay after federal Washington DC.

Its very convenient to make paycheck stub online with this automated check stub maker free. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Although womens wages have always lagged behind mens women today earn about 82 cents for every dollar earned by a man its difficult to pinpoint.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. The top ten percent of employees in the Veterans Health Administration earn 28 of the total income. Let us help you make an informed decision about what it will cost to live and work in the city of.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. In November 2019 before the pandemic the difference was 31. Taxes Updated for 2022 tax year on Aug 02 2022.

A financial advisor in Connecticut can help you understand how taxes fit into your overall financial goals. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Total Gross Earnings.

Learn More About The Massachusetts State Tax Rate H R Block

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Personal Financial Planning Salary

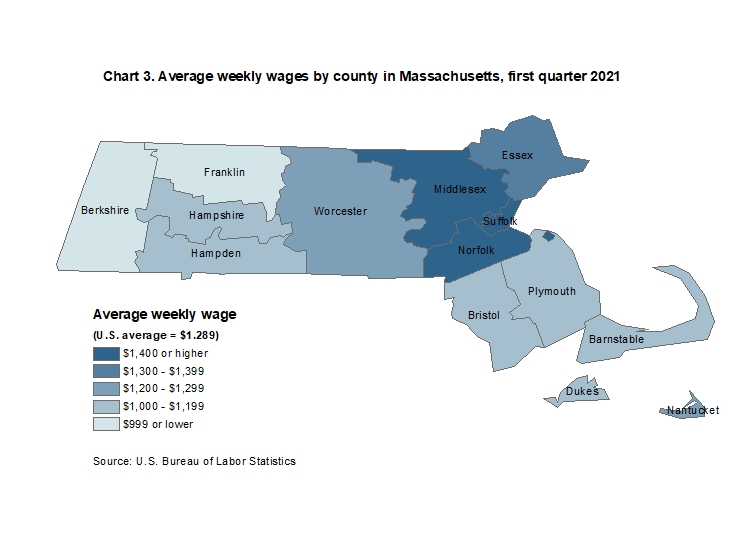

County Employment And Wages In Massachusetts First Quarter 2021 New England Information Office U S Bureau Of Labor Statistics

Average Salary In Massachusetts 2022 The Complete Guide

Here S How Much Money You Take Home From A 75 000 Salary

Massachusetts Paycheck Calculator Tax Year 2022

Massachusetts Income Tax Rate And Brackets 2019

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

![]()

Massachusetts Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Ppc Jobs Salary Guide Infographic Salary Guide Marketing Jobs Digital Marketing Manager

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

Women S Earnings In Massachusetts 2019 New England Information Office U S Bureau Of Labor Statistics

Massachusetts Wage Calculator Minimum Wage Org

Massachusetts New England Information Office U S Bureau Of Labor Statistics

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Smartasset

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar